Why the Odds of a U.S. Recession Are Very High

Are we going to see a soft landing in the U.S. economy, or will there be a severe recession?

While the vast majority of economists agree that a soft landing could be ahead, it wouldn’t be wise to rule out a severe recession for the U.S. economy just yet. The chances of it are still way too high.

Here’s the thing: much of the argument for a soft landing is based on the idea that consumer spending is resilient. Sadly, this isn’t the case, and that’s increasing the odds of a much worse recession for the U.S. economy.

Consumers Are Getting Frugal

Consumers in the U.S. have started to get frugal; they’ve been trying to cut costs wherever they can.

For instance, according to a recent study, almost one-quarter of U.S. subscribers to major streaming services such as “Apple TV+,” “Disney+,” “Netflix,” and “Paramount+” have cancelled at least three of their subscriptions over the past two years. (Source: “Americans Are Canceling More of Their Streaming Services,” The Wall Street Journal, January 2, 2024.)

Streaming services are relatively cheap, so they don’t necessarily break the bank. However, if consumers are getting rid of them, it could be a sign that people are struggling financially.

Credit Card Delinquency Is on the Rise

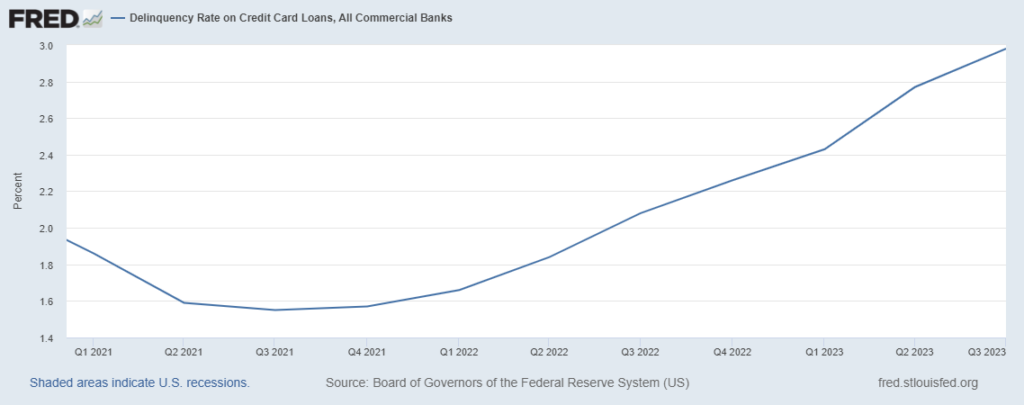

Take a look at the chart below. It plots the delinquency rate for credit card loans for all commercial banks in the U.S.

As per the most recent data, the credit card delinquency rate in the U.S. stands at 2.98%.

Here’s what’s troubling: this rate has been consistently increasing, and it’s currently the highest it has been since early 2012. Even more troubling: although it hit a historic low of 1.55% in the third quarter of 2021, just eight quarters later, it went to 11-year highs!

(Source: “Delinquency Rate on Credit Card Loans, All Commercial Banks,” Federal Reserve Bank of St. Louis, last accessed January 16, 2024.)

The Last Time This Happened, the U.S. Economy Went Into a Recession

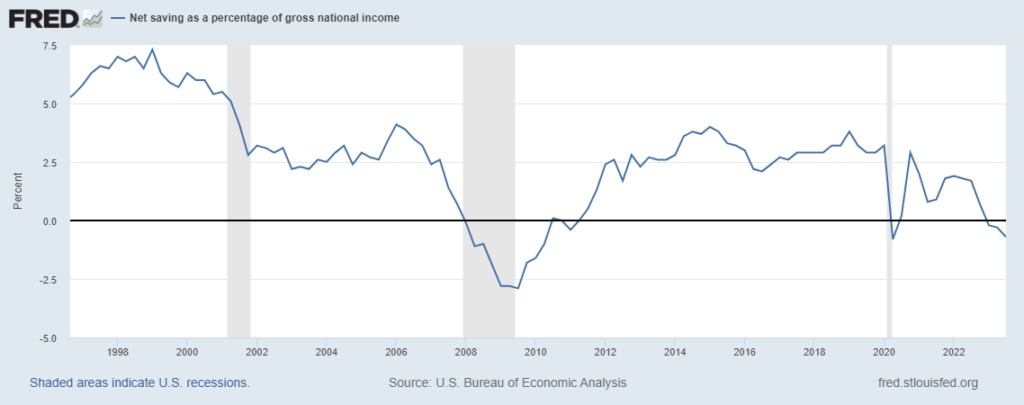

Now, take a look at another chart below. It plots U.S. net savings as a percentage of gross national income. Think of this as how much the U.S. saves as a percentage of the country’s income.

As of the third quarter of 2023, U.S. net savings as a percentage of gross national income were -0.7%. This is not a misprint. The last time U.S. net savings were in negative territory was back in 2020. Prior to that, it was in the 2008–2009 period.

As shown in the following chart, whenever the U.S. net savings figure has taken a nosedive, a recession for the U.S. economy has almost always followed (or had already started). This has been the case since the 1950s.

(Source: “Net Saving as a Percentage of Gross National Income,” Federal Reserve Bank of St. Louis, last accessed January 16, 2024.)

Stock Market Isn’t Ready for a Severe Recession for the U.S. Economy

Dear reader, I look at all this data about consumers and can’t help but wonder if there will be a severe recession for the U.S. economy, rather than the soft landing that many economists are currently predicting.

Moreover, the stock market isn’t priced for a severe recession, and that’s something that shouldn’t be ignored.

How do I know this?

Just look at the current valuations of the stock market. For instance, the S&P 500 is trading at a forward 12-month price-to-earnings (P/E) ratio of 19.5. This is well above the five-year average of 18.9 and the 10-year average of 17.6. (Source: “Earnings Insight,” FactSet, January 12, 2024.)

If the odds of a severe recession in the U.S. economy increase (there’s certainly a possibility of it), the stock market could be in for a rude awakening. We could see an immense selling of shares, with investors rushing for the exits.

So, be very careful before going all in on stocks.